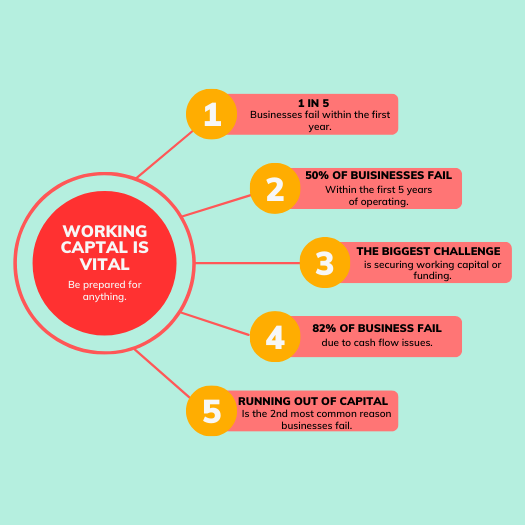

Working capital is essential for any business to operate smoothly. No matter the size of a business, you’ll need adequate working capital to cover your day-to-day expenses. While a working capital loan can be a valuable financing option for any business, it’s important to know how to use it and which lender suits you and your business.

What is an unsecured working capital loan?

A working capital loan provides short-term funding to cover a business’s day-to-day expenses. Unlike long-term loans, working capital loans are easier to obtain and have a fast approval process. These loans are typically used to cover the cost of inventory, payroll, cash flow, and other overhead expenses.

Is it secured or unsecured?

There are different types of working capital loans available, including secured and unsecured working capital loan. Secured loans require collateral, such as inventory or equipment, while unsecured loans do not. However, in our opinion the best options are with an unsecured working capital loan because of the minimal documents needed and without risking business assets.

We are here to help!

Review your business funding options alone is hard. We can make it easy.

Types of working capital funding options.

Business Line Of Credit

Similar to a business credit card but with more flexibility. It is a long term working capital financing solution that allows a business to borrow funds as often as needed. With most small business credit lines, you can choose your own repayment plan each time you draw funds.

Unsecured working capital loan

A short term loan that provides funding in one lump sum. Ideal for business owners who need flexible and quick funding without the hassle of traditional banking. These short term funding programs help stabilize cash flow and have an easy application process.

Merchant Cash Advance (MCA)

A cash advance is a financial product that provides quick access to working capital for small businesses, with minimal requirements. Through this program a business can advance upcoming revenue into immediate cash today. The repayment of the loan is tied to the business’s revenue, making it an attractive option for companies with fluctuating sales. MCAs are 10x more accessible than traditional bank loans and can be approved within a few hours.

Ideal uses vs non ideal uses of unsecured working capital loan.

It’s important to use working capital wisely and avoid non-ideal uses like non-essential expenses or to cover debt payments.

Ideal

- Inventory purchases

- Covering payroll

- Fund marketing & advertising campaigns

- Invest in new equipment & technology

- Expand into new markets

- Temporary cash flow support

- Bridge accounts receivables gap

- Hire more staff

Non-Ideal

- Finance long term investments

- Purchase real estate

- Finance vehicles

- Non essential expenses

- Cover debt payments

- Starting a new business

Key Point: Working capital funding should be used to support your business and avoid unnecessary expenses that could jeopardize your business’ financial health.

How to qualify for an unsecured working capital loan?

Qualifying for an unsecured working capital loan typically requires a few key factors. Lenders will require the business to have been in operation and must also generate a certain amount of revenue each month. Personal credit score is also taken into consideration, as this can be an indication of ability to repay the loan. Below you can see entry level requirements:

Minimum Credit Score

550

Minimum Monthly Revenue

15K

Time In Business

6m

When it comes to applying for an unsecured working capital loan, it’s important to keep in mind that every lender has their own unique set of requirements and funding process. No two lenders are the same, which means that the process of obtaining financing can vary greatly from one lender to the next.

Have anymore questions? Let’s talk!

Key Point: As a borrower, it’s important to do your research and shop around to find a lender that aligns with your specific needs or save yourself the hassle and allow us to do the work for you. By exploring your options with us, you can increase your chances of securing working capital funding that meets your business’ unique needs. Finding the right working capital lender can make all the difference in the success and growth of your business, but doing it alone is time consuming and can be overwhelming.

How to apply for an unsecured working capital loan?

We make it easy to secure funding for your business. Our process starts with a brief online form and the submission of the most recent 4 months of bank statements. We’ll ask for basic information about your business, including your industry, monthly revenue, and time in operation.

Once we receive all necessary documents, our experienced team will work tirelessly to secure your best unsecured working capital loan option. We pride ourselves on a simple and straightforward funding process, free from application fees or complicated paperwork. If approved, we’ll collaborate with you to finalize the terms and funding arrangements

Frequently asked questions

A working capital loan provides short-term funding to cover a business’s day-to-day expenses. Easier to obtain than a term loan and have a fast approval process.

Unsecured working capital loan provides fast funding without pledging any assets or collateral. This type of financing considers your business’ cash flow to determine how much you qualify and amount of funds you can borrow.

Unsecured working capital loans offer a number of advantages over secured loans. Here are some of the key benefits. No collateral required, faster approval times, and greater flexibility in funding amounts and repayment terms.

At Valid Financing, we make the process to secure funding simple and straightforward. All we need to start the funding process is a 1-page application & 4 months of business bank statements.

The first step is to hit the “Get Started” button and complete quick contact form. After completed the form, one of our experts will reach out to you ASAP. We coordinate with you to ensure, we can find your ideal fit

If approved, you will have offers to review within 24 hours. Please keep in mind the process cannot begin until all necessary documents have been submitted.

The best time to secure an unsecured working capital loan depends on your specific needs and situation. In general, it’s a good idea to apply for financing when you need it, rather than waiting for a desperate situation. It is also beneficial to review offers when you have a clear understanding of your business’ needs and goal.

An unsecured working capital loan may be a good option for your business if you need short-term funding to cover operating expenses or unexpected costs. One of the main benefits of an unsecured loan is that it can provide you with quick access to cash, typically within a few days to a week. This can be especially helpful if you need to cover a sudden expense or take advantage of a time-sensitive opportunity.